All about

US Wires

A wire transfer is a method of transmitting money electronically between people or businesses in which no physical money is exchanged. The sender is the one who provides all the instructions for the transfer, which may include the recipient’s name, bank, account number, amount, and sometimes a pickup location.

Fedwire: What you need to know

Wire payments are at the heart of many banking institutions. They are generally used for high value payments (also known as wholesale payments) but also support end user payments, like your mortgage down payments.

Fedwire is a real-time gross settlement transfer system that allows participating financial institutions to send and receive same-day fund transfers. It processes trillions of dollars per day, settling transactions individually and immediately. Once settled the transaction is permanent and irrevocable. Meaning if a wire was sent incorrectly the receiver of the funds would need to initiate a return payment to send the money back. In processing payments individually, it differs from CHIPS which is a netting engine that aggregates payments.

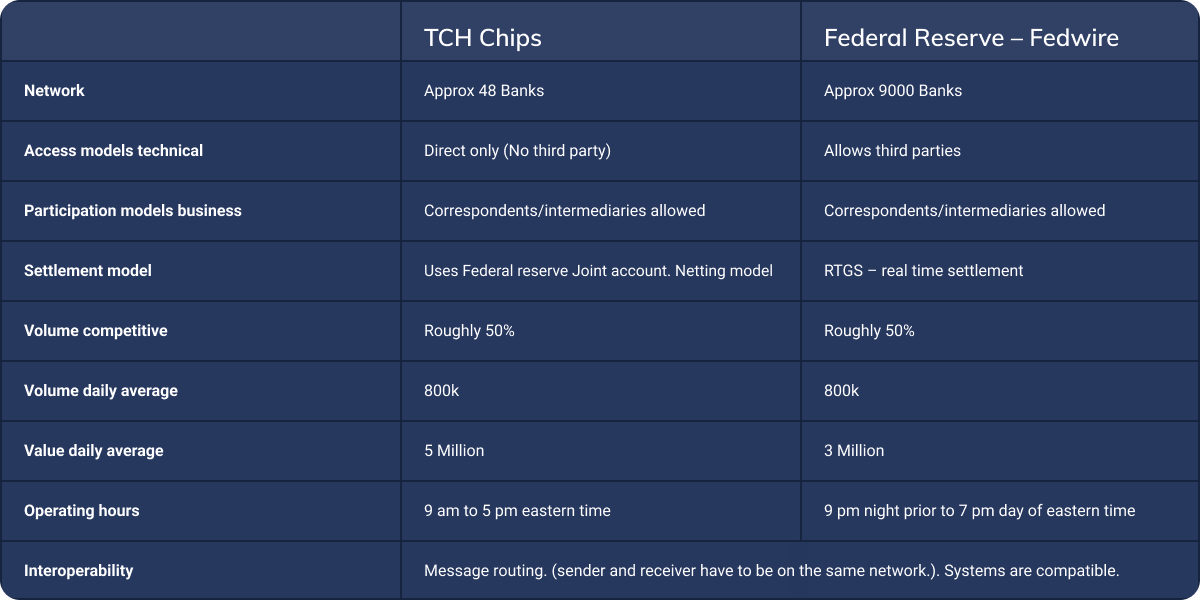

Wire payments in the US can clear and settle through two different operators: The Federal Reserve's Fedwire Funds service or the Clearing House's CHIPS service. These two schemes work slightly differently:

- The Fedwire service utilizes master accounts at the Federal Reserve

- The Clearing House CHIPS service utilizes a joint account at the federal reserve where funds are moved in and out at the start and close of the Fedwire cycle date. This allows the clearing house to net the amounts during the day saving the banks fees and ensuring efficient liquidity management throughout the day

Banks may choose to send a wire over Fedwire or CHIPS based on business decisions like if the receiver is on the network (CHIPS has around 46 or so participants while Fedwire has thousands) and other requirements for liquidity/netting and such.

Fedwire Direct Transfer

The diagram below shows a simple Fedwire transfer where both banks are Fedwire participants.

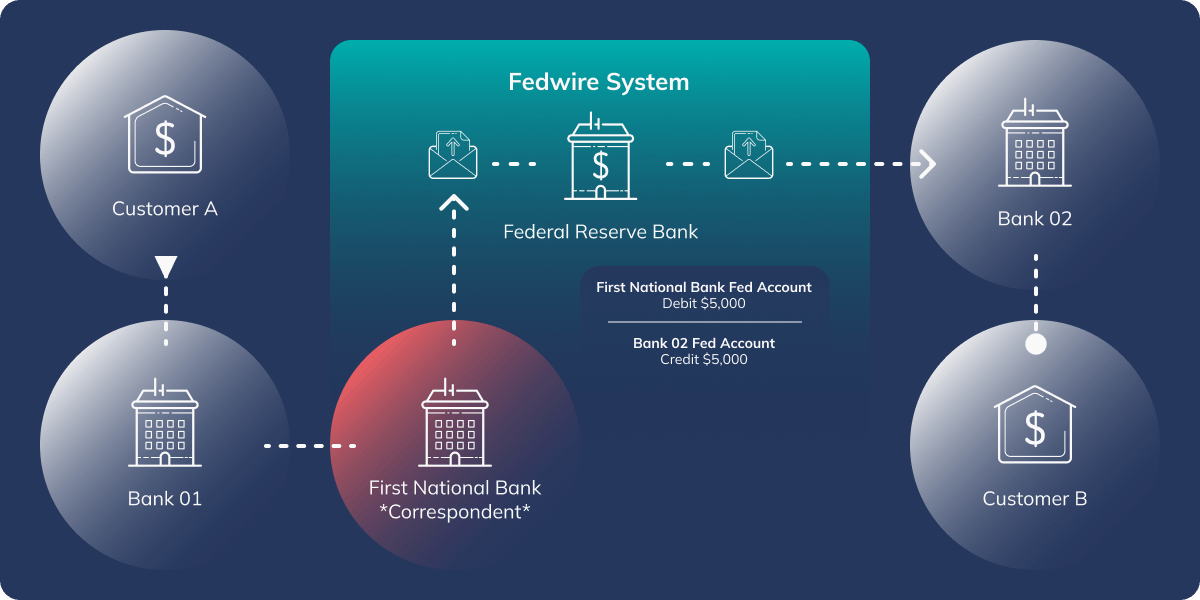

Fedwire Indirect Transfer

This second diagram outlines what happens when a financial institution that is not a Fedwire participant needs to send or receive a wire transfer. It must partner with a Fedwire participant institution to complete the transfer on its behalf.

The move to ISO 20022

The ISO 20022 standard is being adopted by an increasing number of the world’s payments, clearing and settlement systems, and is expected to grow significantly in years to come. As part of the work to modernize B2B payments, the Federal Reserve is also moving to this new messaging standard from its current proprietary formats. The two key milestones for this move are:

- CHIPS migration is planned for November 2023.

- Fedwire migration is planned for March 2025.

What ISO 20022 brings is a much richer data scheme and more structured information into the processing that’s going to have benefits for financial institutions as well as their customers. Financial institutions will benefit from access to better and more structured data, which makes scanning for sanctions and fraud easier and more robust, and drives down exceptions resulting in reduced operations costs. Customers will benefit from improved reconciliation and easier management of payments.

High Value Schemes

The two main payment types can be further broken down by features such as settlement type, network size, transaction volume, and operating hours, as shown in the chart below.