Sibos 2023: Unveiling the Power of Modern Payment Platforms

· min September 28, 2023

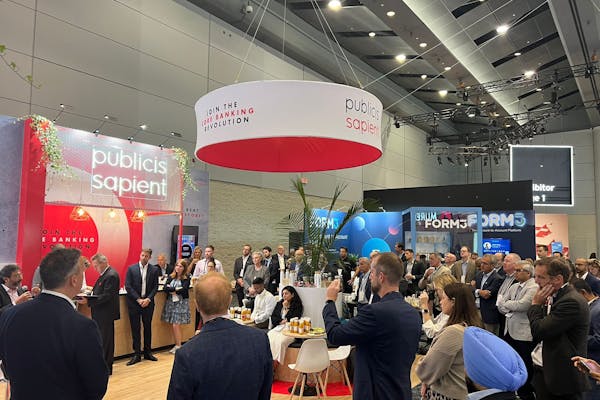

In a captivating breakfast panel session Luke McAlpine of Thought Machine, Julian Colls from Form3, and Pankaj Chhabra of Publicis Sapient provided insights on the current state of payment platforms as well as what the future may hold for payment innovation.

Colls initiated the session, shedding light on a pressing challenge many banks grapple with: the constraints of siloed point solutions. "Banks find themselves often with disparate point solutions, leading to fragmented data and escalating costs," he observed. This fragmentation not only impedes the seamless adoption of real-time payments but also amplifies operational intricacies. He further elaborated on the complexities banks face in integrating multiple vendor solutions, which often lead to inefficiencies and a lack of synergy.

Echoing Colls, McAlpine spoke on the technological fragmentation, highlighting the repercussions of siloed data. "The rapid pace of change, whether spurred by regulatory shifts or evolving customer expectations, demands agility – something legacy systems often stifle," he commented. He further explored the challenges banks face in staying ahead of the curve, especially in an era where digital transformation is not just a buzzword but a business imperative.

The session then moved onto what some of the key attributes are for a successful payments platform. Chhabra championed the merits of flexibility, API integration, and modularity. "Modernisation equips us with the capability to operate systems incrementally, ensuring real-time, straight-through processing," he elucidated. He also touched upon the broader implications of such an approach, highlighting how it can drive operational efficiencies, reduce costs, and enhance customer experiences.

Many clients initially address challenges in their domestic markets, like the UK. Yet, powered by these platforms, they're confidently expanding into new territories, including the US

Julian Colls · Chief Customer Officer

Colls further extolled the platform approach's advantages, emphasising its evergreen compliance with regulatory changes. "Such platforms are designed for resilience, scalability, and peak performance. It's a universal need, transcending competition," he asserted. He also added the strategic advantages of adopting a platform-centric approach, highlighting how it can serve as a catalyst for innovation and growth.

The conversation then pivoted to practical applications. Colls highlighted the global ambitions of several businesses, noting, "Many clients initially address challenges in their domestic markets, like the UK. Yet, powered by these platforms, they're confidently expanding into new territories, including the US." He further explored the strategic considerations businesses must take into account when expanding globally, emphasising the role of payment platforms in facilitating such expansion.

However, the true power of these platforms extends beyond geographical reach. Colls accentuated discussed data capabilities, stating, "A platform-centric approach ensures uniform integration and messaging." This seamless data flow paves the way for proactive fraud detection, with Colls citing examples of how this could be used to combat authorised push payment fraud as a example.

McAlpine spotlighted the adaptability inherent in modern payment platforms. "While ISO 20022 currently dominates electronic data interchange, platforms must be agile enough to accommodate future standards," he remarked. He also touched upon the evolving customer landscape, where speed, efficiency, and transparency reign supreme, underscoring the modular platform's significance.

The session concluded with the speakers highlighting how the pace of change in payments shows no signs of slowing down, and so the emphasis on adaptability, innovation, and foresight becomes even more pronounced. The era of rigid legacy systems is waning, making way for agile platforms that herald a transformative era for payments.