FedNow at Two: Building Real-Time Rails That Work for the U.S.

Blog· 4min July 22, 2025

When the Federal Reserve launched FedNow in July 2023, it did so with a clear goal: to make instant, always-on payments a core capability of the U.S. banking system. Two years in, the progress is measurable—but so are the questions.

How close are we to ubiquity? How well is FedNow positioned to coexist with (and complement) the RTP® network. other railsAnd what does success look like in a market as complex and decentralized as the United States?

From Early Adopters to Ecosystem Momentum

FedNow’s rollout began with around 35 institutions, ranging from large banks to credit unions. The go-slow approach wasn’t about hesitation—it was about laying groundwork: testing, learning, and scaling responsibly.

Since then, adoption has broadened. By mid-2025, over 1300 financial institutions have onboarded. Participation is growing fastest among regional and community banks, which often see FedNow as a chance to leapfrog legacy constraints and compete on experience.

This isn’t just about reach—it’s about readiness. Institutions aren’t just signing up; they’re experimenting, launching use cases, and integrating real-time into core customer journeys.

Feature Enhancements: Filling in the Rail

Rail adoption doesn’t happen in a vacuum. Financial institutions need features and tooling that de-risk participation and unlock return on investment. In the past 18 months, FedNow has made meaningful progress:

01

Request for Payment (RfP): Supports structured, invoice-style requests—critical for B2B and recurring bill flows.

02

Fraud mitigation controls: Tiered risk thresholds, limits, and controls that reflect institutional risk tolerance.

And perhaps most importantly, there’s increased engagement around interoperability. While FedNow and the RTP network still operate independently, the pressure is mounting for coordination—especially as end users increasingly expect network-of-networks behavior rather than siloed functionality.

Use Case Growth: From Concept to Flow

It’s one thing to have the infrastructure—it’s another to get volume. FedNow’s early volumes were modest, focused largely on internal settlement pilots. But the past year has seen a shift from exploration to flow.

Use cases gaining traction across both rails:

01

Payroll and wage disbursement – Instant pay for hourly workers, gig economy participants, and off-cycle events.

02

Insurance payouts – Accelerating time-to-cash during moments of need.

03

Bill pay – Empowering consumers to time payments precisely and avoid late fees.

The Federal Reserve reports tens of millions of transactions processed as of early 2025, with consistent quarter-over-quarter growth. This growth may not be exponential—but it's durable. It signals a rail transitioning from potential to utility.

FedNow vs. The RTP Network: Coexistence, Not Competition

No conversation about real-time payments in the U.S. is complete without comparing FedNow to The Clearing House’s the RTP network. And while headlines may frame it as a rivalry, the reality is more nuanced: we’re seeing rail coexistence, not a zero-sum contest.

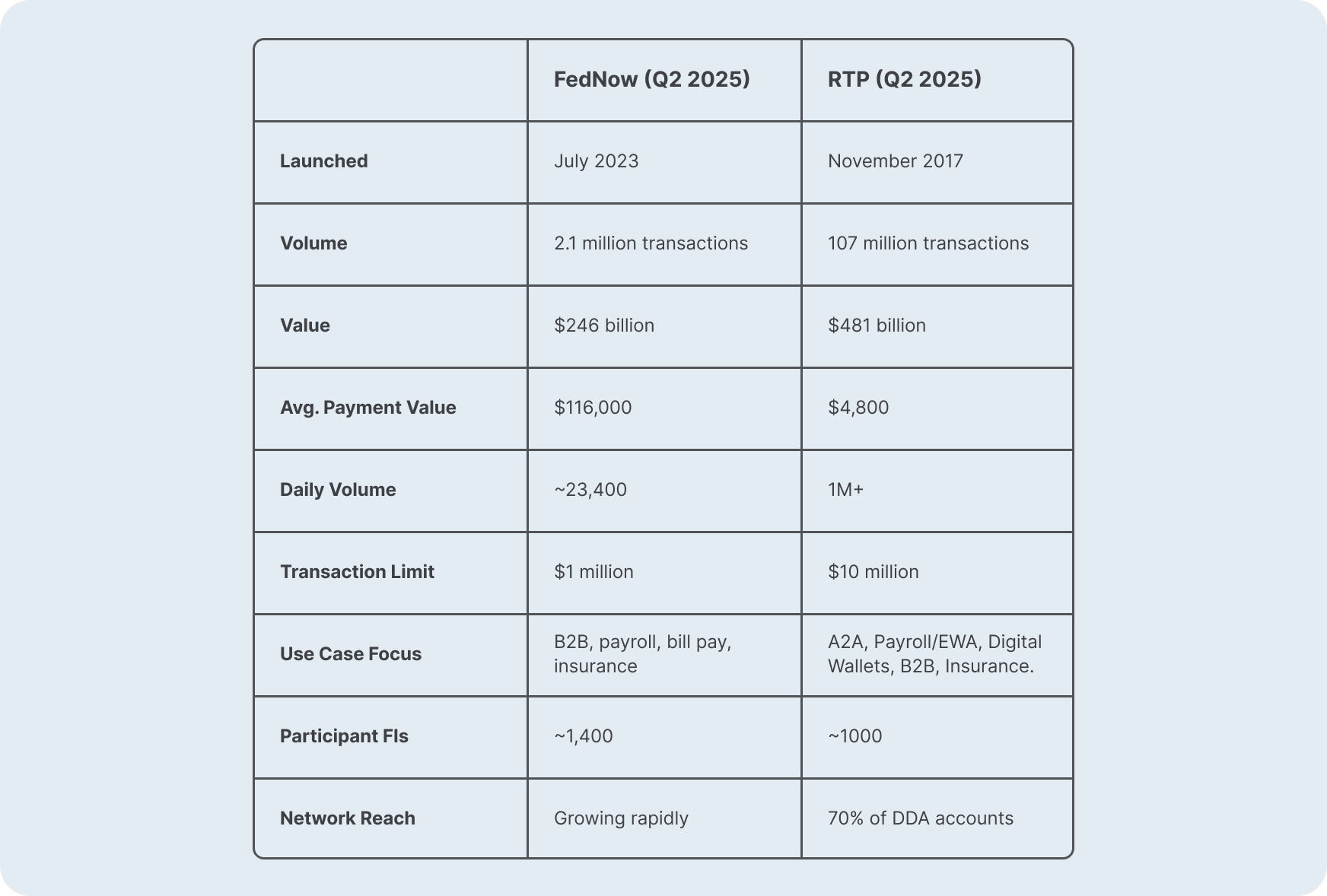

Here’s how they currently stack up:

The RTP network leads in transaction volume and reach, largely due to its earlier start and strong traction in A2A transfers like bank to bank, brokerage, and wallet defunding P2P as well as consumer-facing flows like earned wage access. In the first quarter of 2020, a bit after the 2-year anniversary for RTP – they showed roughly 10 million transactions a quarter and about 50 million in value.

FedNow, on the other hand, is carving out space in larger-value, time-sensitive B2B and institutional payments—often where risk tools and liquidity visibility are critical.

Both networks serve different segments. The long-term opportunity lies not in picking winners, but in building connective tissue across them—common messaging formats, fraud signals, and identity layers that allow banks and fintechs to deliver a unified experience, regardless of the underlying rail. The ecosystem is being looked at to solve for this, with service providers like Form3 providing intelligent routing capabilities, allowing FI’s to not have to worry about building to two different rails, and being able to send an instant payment without worrying concern around the differences between FedNow and the RTP network.

What’s Next: Building Density and Depth

FedNow’s growth raises important questions—not just about adoption, but about coexistence. As we explore in our latest Finextra report, The Future of Payments in Major Global Markets: A Mid-Decade Review, the U.S. doesn’t need one rail to win.. It needs multiple rails to connect. The work ahead includes:

01

Creating meaningful interoperability frameworks between FedNow, the RTP network, and emerging nonbank solutions

02

Aligning on rules, risk, and identity standards that enable safe, frictionless cross-rail experiences.

03

Accelerating end-user value—because real-time speed is only as powerful as the use case it serves.

The U.S. doesn’t do “mandates.” It does markets. FedNow’s evolution will be shaped by the collective actions of participants—and their ability to move from real-time capability to real-time strategy.

Written by

Miriam Sheril is the Head of Product in the US at Form3 with responsibility to build out and enhance Form3’s product capabilities in the US, focusing real time payments and other rails such as the Federal Reserve’s FedNow service and The Clearing House’s RTP service. Miriam comes with more than 13 years’ experience in financial services, where she focused on product and software development and management. She joins Form3 from the Federal Reserve Bank, where she was most recently the FedNow Core Product Manager Lead AVP, responsible for the design and build of the FedNow product since its inception.

Let’s Build the Future of Real-Time Payments—Together

At Form3, we’re committed to helping financial institutions thrive in a world of multiple rails. Our cloud-native platform enables seamless access to both FedNow and RTP through a single connection—simplifying operations, reducing risk, and enabling smart routing based on value, urgency, and availability. Whether you're a large institution or a community bank, we can help you deliver real-time payments with confidence and clarity.

Back to News

Back to News