Verification of Payee Regulation: Essential Information for Compliance

Blog· 3min March 3, 2025

In today’s fast paced world of instant payments, ensuring the security and accuracy of transactions is paramount. Imagine a scenario where a simple typo in the payee's IBAN leads to a significant financial loss due to a misdirected payment. Such incidents highlight the critical need for robust verification mechanisms. For SEPA instant in the EU one significant development in this area is the Verification of Payee (VoP) service.

In the following article, we explore the intricacies of VoP, including its definition, regulatory framework, operational mechanics, and the crucial elements of the VoP scheme rulebook.

What is Verification of Payee?

Verification of Payee scheme is a set of rules, practices and standards designed to enhance the security of SEPA payment transactions by verifying the identity of the payee before a payment is authorised. When consumers or businesses make payments, the Verification of Payee informs them if the money is going to the right account. Before they transfer the funds, they can check that the name on the recipient account matches the person or business they intend to send the money to, so funds end up in the right place.

Verification of Payee Regulatory Background

The introduction of the verification of payee rulebook is driven by the Instant Payments Regulation (IPR), which was published in the Official Journal of the European Union in March 2024. The regulation mandates that Payment Service Providers (PSPs) offer VoP services at no additional charge to their customers. Key requirements include:

01

Mandatory VoP Check: The VoP check must be performed before the payer authorises the credit transfer.

02

Notification of Close Matches: In cases of close matches, the payer must be informed of the name associated with the provided IBAN.

03

Liability and Refund Rights: PSPs must inform payers about the implications for PSP liability and payer refund rights if the payer chooses to ignore a notification provided by the VoP service.

04

Union-wide Standards: The service should be carried out in accordance with a Union-wide set of rules and standards, which are developed by organisations representing PSPs.

The regulation stipulates that for PSPs in the Euro area, VoP services must be offered by 9 October 2025, 18 months after the entry into force of the IPR.

How Verification of Payee Works

The VoP process involves several key actors and steps to ensure the accurate verification of payee details. The main actors in the VoP scheme are:

01

Requester: The individual or entity initiating a payment.

02

Requesting PSP: The PSP with whom the Requester intends to make the payment.

03

Responding PSP: The PSP receiving the VoP request and processing it.

04

Routing and Verification Mechanisms (RVMs): Entities that facilitate the routing and verification of VoP requests and responses.

The VoP process can be summarised as follows:

01

Initiation: The Requester provides the payment details to the Requesting PSP.

02

Preparation: The Requesting PSP verifies that all mandatory attributes are provided and prepares the VoP request message.

03

Transmission: The VoP request is sent to the Responding PSP, either directly or via an RVM.

04

Verification: The Responding PSP checks the provided details against its records and generates a VoP response.

05

Response Handling: The VoP response is sent back to the Requesting PSP, which then informs the Requester of the result.

The entire process is designed to be completed within a maximum execution time of three seconds, with a preference for one second or less.

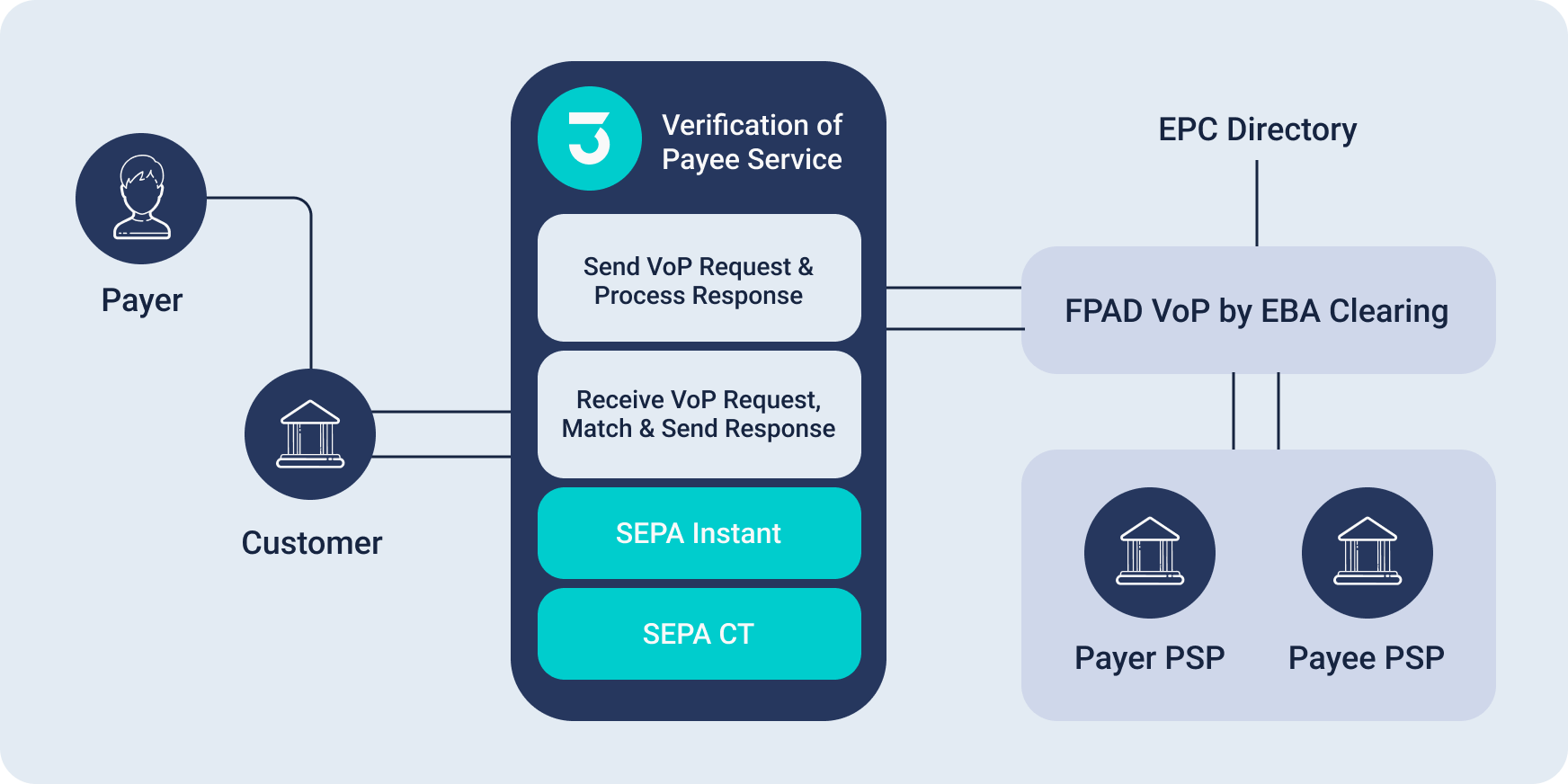

VoP Service Overview

Verification of Payee Scheme Rulebook

The European Payments Council (EPC) has developed a comprehensive rulebook to guide the implementation of the VoP scheme. The rulebook outlines the technical specifications, operational procedures, and compliance requirements for PSPs. Key components of the rulebook include:

01

Scope and Reachability: The VoP scheme applies to payments within the Single Euro Payments Area (SEPA) and must be available 24/7/365. It covers both euro and non-euro PSPs.

02

Adherence: Account-Servicing PSPs can participate as both Requesting and Responding PSPs, while other PSPs can participate at least as Requesting PSPs.

03

Data Requirements: The rulebook specifies the mandatory and optional attributes that must be included in VoP requests and responses, such as the IBAN, BIC, and the name of the payee.

04

Response Types: The rulebook defines the possible responses to a VoP request, including match, no match, and close match. It also provides guidelines for handling non-matching results and delayed responses.

The EPC released the formal version 1.0 of the VoP scheme rulebook on 10 October 2024, with the scheme entering into force on 9 October 2025.

Verification of Payee regulation: The next chapter

Verification of Payee (VoP) is a crucial service that enhances the security and accuracy of SEPA instant transactions. By understanding the regulatory background, how VoP works, and the key components of the VoP scheme rulebook, heads of payments at European banks can better prepare for its implementation. In the next part of this blog series, we will explore the practical aspects of implementing VoP in your bank, including technical requirements, operational considerations, and best practices.

Stay tuned for Part 2, where we will provide detailed guidance on how to successfully integrate VoP into your payment systems and ensure compliance with the upcoming regulatory deadlines.

Frequently Asked Questions

How do I verify a payee?

To verify a payee, the Verification of Payee (VoP) service is used. This process involves several steps:

01

Initiation: The payer (Requester) provides the payment details, including the payee's name and IBAN, to their Payment Service Provider (PSP).

02

Preparation: The Requesting PSP verifies that all mandatory attributes are provided and prepares the VoP request message.

03

Transmission: The VoP request is sent to the Responding PSP, either directly or via a Routing and Verification Mechanism (RVM).

04

Verification: The Responding PSP checks the provided details against its records and generates a VoP response.

05

Response Handling: The VoP response is sent back to the Requesting PSP, which then informs the payer of the result. The response can indicate a match, no match, or close match.

The entire process is designed to be completed within a maximum execution time of three seconds, with a preference for one second or less.

What are verification of payee providers in Europe?

Verification of Payee (VoP) providers in Europe are primarily Payment Service Providers (PSPs) that participate in the VoP scheme. These include:

01

Requesting PSPs: PSPs that initiate the VoP request on behalf of the payer.

02

Responding PSPs: PSPs that receive the VoP request and verify the payee's details.

03

Routing and Verification Mechanisms (RVMs): Entities that facilitate the routing and verification of VoP requests and responses. These can include payment clearing and settlement providers, automated clearing houses, or intra-PSP and intra-group arrangements.

The European Payments Council (EPC) oversees the development and maintenance of the VoP scheme rulebook, which sets the standards and guidelines for these providers.

What is payee validation?

Payee validation, in the context of the Verification of Payee (VoP) service, refers to the process of confirming that the name of the payee matches the account details provided (such as the IBAN). This validation is performed before the payer authorises the credit transfer to ensure that the payment is directed to the correct recipient. The VoP service helps to prevent fraud and errors by verifying the identity of the payee, thereby reducing the risk of misdirected payments. The validation process involves checking the provided details against the records of the Responding PSP and generating a response indicating whether the details match, do not match, or are a close match.

Back to News

Back to News