Will all Banks and PSP’s require their own Sort Code from July 2019?

Thought Leadership· 2min November 4, 2019

Will every UK financial institution receiving payments require its own Sort Code by July 2019, as a consequence of the Confirmation of Payee (CoP) implementation? ...

Will every UK financial institution receiving payments require its own Sort Code by July 2019 (see post), as a consequence of the Confirmation of Payee (CoP) implementation?

Currently, many financial institutions use a collection bank account rather than obtaining their own a sort code via their settlement bank.

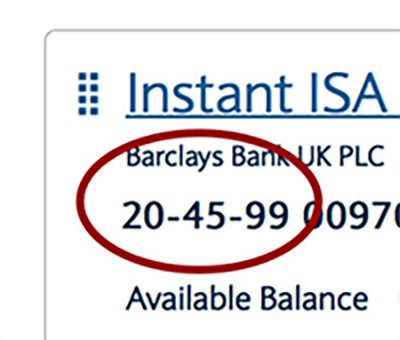

An example on having your own Sort Code

Let’s assume ABC Payments Ltd uses their account at XYZ Bank, acting as the settlement bank, to receive payments. Once Confirmation of Payee is adopted in mid 2019, let's imagine that the bank of Mr Patel, who is looking to send money to Mr Jones’ account with ABC, is setting up Mr Jones as a new beneficiary.

The bank will identify that the beneficiary sort code is that of XYZ Bank, and send the CoP request to XYZ Bank. XYZ Bank has no knowledge of the individual accounts held in ABC Payments Ltd books and will respond “No match”.

Mr Patel’s bank therefore will advise him either not to set-up the new beneficiary or to proceed at his own risk. Either way ABC Payments Ltd using a collection account with XYZ Bank, effectively will no longer receive Faster Payments.

A work around may be to advise Mr Patel to add ‘ABC Payments Ltd’ as the beneficiary rather than ‘Mr Jones’. However, if the money is then paid into the account of ‘Ms Fraud’ he will have no CoP protection.

The solution therefore is for ABC Payments Ltd to ask XYZ Bank to assign them a dedicated sort code and then they can allocate a directly FPS addressable account numbers to each one of their clients. They can also participate directly in CoP.

Use of industry modulus algorithms on that sort code, would result in ABC Bank receiving fewer misdirected payments, as keying errors should be caught by the remitter. An additional benefit is that the sort code is portable to another bank, so it is much easier to for ABC Payments to switch banks in the future.

The Payments Systems Regulator @PSR may well be very happy with this perhaps unintended consequence of their mandating Faster Payment participants to implement CoP by July 2019. It improves banking competition and encourages the adoption of CoP and reduces misdirected payments.

Financial Institutions without their own sort code, would be well advised to ask their banks for their own sort code.

Form3 provides an API driven account management service which allocates accounts on pseudo random basis. (See link for the fraud problems Tesco Bank had with sequential debit card numbers).

Form3 also provides API driven advice of Bacs and Faster Payments receipts for financial institutions, and automatically return payments to non-live accounts providing an effective management service to customers for this kind of exception handling.

Form3 is planning to provide a service to respond to CoP requests on behalf of institutions like ABC Payments Ltd, using their own sort code so that Mr Patel can receive ‘Matched’ to his CoP request.

Written by

Senior Product Manager for Form3 Financial Cloud, a new and innovative company providing FinTech solutions to Financial Institutions. Previously Director for RBS Domestic payment Product Management team. This included UK payments products including Bacs, Faster Payments, CHAPS, Cheques, and Agency Banking.

Back to News

Back to News