Breaking Barriers in International Payments: Form3's Innovative 'Swift as a Service' Solution

Table of contents

Blog· 3min April 26, 2023

The international payments industry is growing rapidly, with a projected global revenue pool of $2.9 trillion by 2025. However, accessing and maintaining cost-efficient access to the Swift network is challenging, due to physical on-premises requirements, complex messaging standards, and the need for multiple vendor integrations. Form3's 'Swift as a Service' offers a cloud-native, API-driven solution that simplifies connectivity and reduces operational overheads.

Cross-border transactions are growing exponentially, with global revenues expected to reach $2.9 trillion by 2025. As businesses seek to capitalise on this lucrative market, they face increasing challenges in accessing international payments and the Swift network. This article examines the problems businesses encounter and introduces Form3's innovative solution: 'Swift as a Service.'

Industry Trends

As the global economy becomes increasingly interconnected, cross-border payments are projected to reach between $150-250 trillion by 2027. With numbers like these, businesses must get their international payment strategies right to stay competitive. Several key trends are shaping the current international payments landscape:

Supervisory Enhancements to Cross-Border Payments (CPMI-BIS)

The Committee on Payments and Market Infrastructures (CPMI) and the Bank for International Settlements (BIS) have been working together to improve cross-border payment systems, promoting faster, cheaper, more transparent, and more inclusive transactions. These organisations have established ambitious targets to be achieved by 2027, which will drive significant changes in the way cross-border payments are processed and regulated. These enhancements are expected to increase the efficiency of international payments, reduce risks, and expand access to financial services worldwide.

Digitisation and Emerging Technologies

Advancements in technology are playing a crucial role in shaping the future of international payments. The increasing digitisation of financial services has led to the development of new solutions and platforms that streamline payment processes, enhance security, and reduce transaction costs. Additionally, machine learning and artificial intelligence can help improve fraud detection and optimise payment routing, further enhancing the overall efficiency of international payments.

Growth in SME and E-commerce

The rapid expansion of small and medium-sized enterprises (SMEs) and e-commerce has led to a significant increase in cross-border transactions. As businesses continue to grow and engage in international trade, the demand for efficient and cost-effective payment solutions becomes even more critical.

Move to Real-Time Cross-Border Payments

Real-time payments have become increasingly popular in domestic markets, and now the trend is moving towards cross-border transactions. The demand for immediate settlement and enhanced transparency is driving the development of new payment infrastructure and solutions that can support real-time cross-border payments. A recent example of this is the partnership between EBA Clearing and The Clearing House with their IXB model. Utilizing existing real-time payment systems, RTP in the US and RT1 in Europe. It is set to process its first live transactions later this year. This move towards faster transactions aims to improve the overall customer experience, reduce operational costs, and increase the competitiveness of businesses engaged in international trade.

Key Challenges Institutions Face When Joining the Swift Correspondent Banking Network

In today's globalised economy, financial institutions are constantly seeking to improve their cross-border payment processes. One popular solution is to join the Swift correspondent banking network, which connects thousands of banks worldwide and facilitates secure, efficient, and reliable international transactions. However, becoming a part of this network comes with its own set of challenges.

Technical access and costs

One of the primary concerns for institutions considering joining the Swift network is the technical complexity and cost involved. Connecting to Swift requires on-site hardware, such as Swift gateways and communication interfaces, as well as the expertise of specialists to manage and maintain these systems. Furthermore, Swift's annual November Standards update where new enhancements or new additions to Swift messages take place, often necessitates significant changes to a bank's infrastructure, leading to additional costs and potential disruption.

Moreover, smaller institutions may find the investment in hardware and expertise to be disproportionately expensive compared to the benefits they receive from joining the network. As a result, they may be deterred from participating, limiting their ability to offer efficient cross-border payment solutions to their customers.

Transition to ISO20022

Another challenge for institutions is managing the transition from the current Swift message format (MT) to the new ISO 20022 standard (MX). Swift plans to migrate to this new standard by 2025, requiring banks to adapt their systems and processes accordingly. This transition may prove difficult for some institutions, particularly those with limited resources and expertise in implementing new messaging formats.

The ISO 20022 standard offers many advantages, such as increased interoperability, richer data, and improved straight-through processing. However, the transition may involve significant costs and effort for institutions to update their systems, train staff, and comply with the new standard within the given timeline.

Demand for greater optionality

Financial institutions are increasingly seeking more flexibility and optionality in their payment processes to enhance efficiency and better serve their customers. This demand for customisation can be challenging within the Swift network, as it often requires additional infrastructure and resources to support bespoke payment solutions.

Institutions may need to invest in supplementary software or third-party services to meet their specific requirements, further adding to the complexity and cost of joining the Swift network.

While the Swift correspondent banking network offers numerous benefits to financial institutions, joining the network is not without its challenges. Technical complexity, the transition to ISO 20022, demand for greater optionality, and compliance requirements all present significant obstacles for institutions seeking to become a part of this global payment network.

To overcome these challenges, institutions may consider partnering with third-party providers or exploring alternative payment solutions that can help them navigate the complexities of the Swift network while still offering efficient, secure, and compliant cross-border payment services to their customers.

Introducing Swift as a Service

Form3's ‘Swift as a Service' was developed to address the challenges faced by businesses when joining the Swift network. As the world’s first cloud-native API only connectivity solution to the Swift network we offer a truly zero-footprint managed service. By eliminating the need for cumbersome hardware and software, we make international payments more accessible, efficient and cost-effective for businesses of all sizes.

How it Works

Form3's Software as a Service (SaaS) model maintains a single code base for all customers. This means that annual standards upgrades, VPN upgrades, and industry migrations to ISO 20022 are applied centrally and rolled out to all customers instantly.

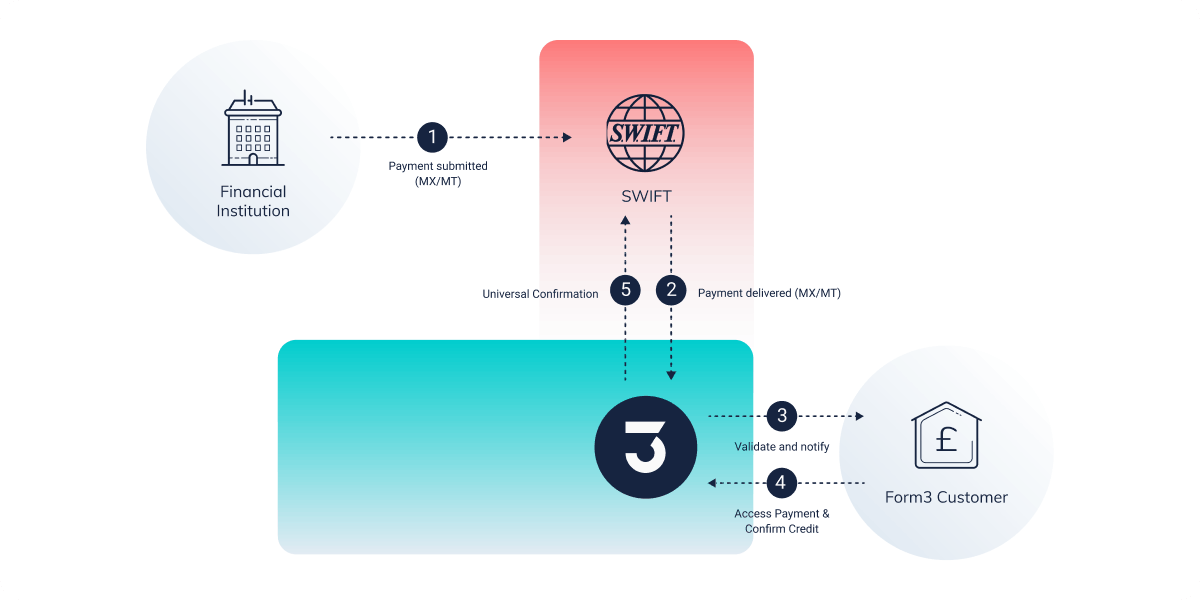

Inbound transactions

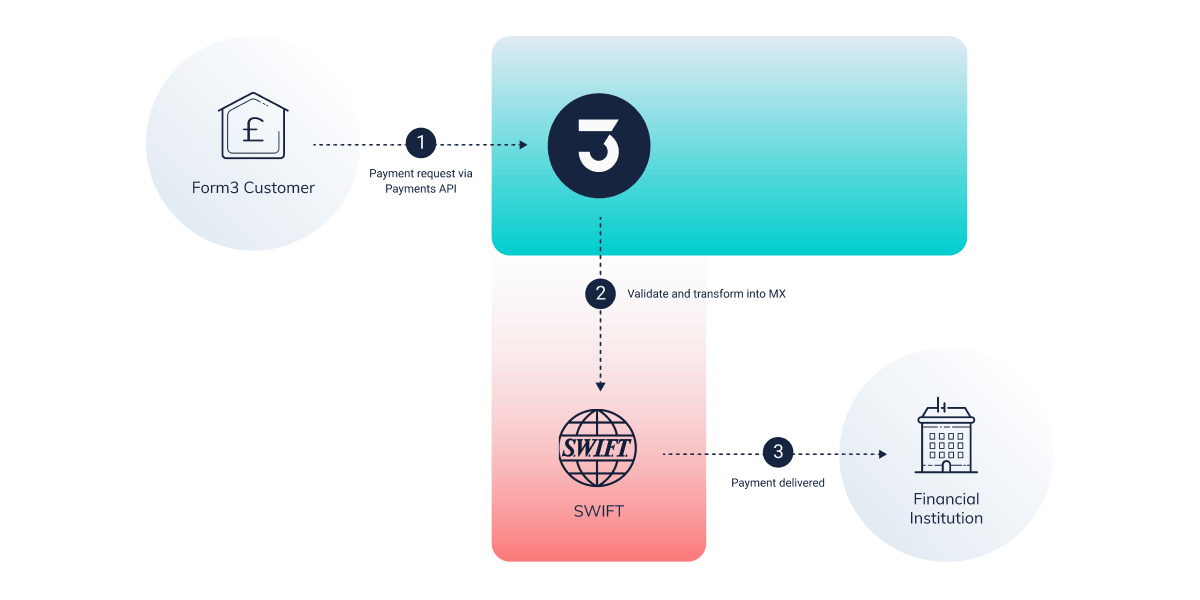

Outbound transactions

Designed to suit varying cloud connectivity needs, Form3's service offers the benefits of a best-in-class cloud-based platform with zero footprint. This single API connects to Swift and numerous other payment gateways, revolutionising the international payments landscape.

Why Choose Form3?

By opting for 'Swift as a Service' from Form3, businesses can:

• Experience seamless connectivity to the vast SWIFT network, encompassing over 11,000 global institutions for unparalleled reach.

• Embrace the future of payments with native ISO 20022 / CBPR+ compatibility, ensuring smooth and efficient transactions.

• Leverage our API-driven, multi-cloud technology to enjoy industry-leading security, resilience, and scalability in your payment processes.

• Simplify your operations with our cloud-native solution, eliminating the need for cumbersome hardware or software installations.

• Focus on your core business as our fully managed service handles the complexities of technology and operations management for you.

• Benefit from our multi-tenant platform, where system and scheme updates are centrally managed to guarantee consistent performance across all users.

• Enhance your payment capabilities with our best-in-class Payments Platform, catering to both international and domestic transactions through a single, user-friendly API.

Conclusion

In a rapidly evolving international payments landscape, businesses need a solution that keeps pace with industry trends and overcomes the complexities of accessing the Swift network. Form3's 'Swift as a Service' offers an innovative, cloud-native, and fully managed connectivity model that addresses these challenges head-on.

By providing direct access to the expansive Swift network and supporting native ISO 20022 / CBPR+ compatibility, Form3 enables businesses to process transactions faster, cheaper, and more efficiently. With industry-leading security, resilience, and scalability, 'Swift as a Service' is the perfect solution for businesses looking to capitalise on the growing opportunities in cross-border payments.

Back to News

Back to News