How does the Queen’s speech tackle the APP Fraud problem?

Thought Leadership· 10min May 20, 2022

It is often said that fighting fraud is an arms race, as financial institutions invest into better solutions to fight the latest fraud schemes, criminals are already developing a new one.

In the past decade, Authorised push payment (APP) fraud has proven to be the most difficult to tackle, raising numerous challenges for PSP’s, Banks, and Regulators alike. It is now the fastest growing type, and recently overtook card fraud in the first half of 2021, becoming the most prevalent type of fraud in the UK.

Other markets where instant payments are emerging as an option of choice for customers are now slowly being faced with the same challenges. In 2021 the French Central Bank reported that 58% of the fraud committed in direct bank payments was in fact APP fraud.

What is APP Fraud?

The fraud involves the criminal tricking their victims into willingly making large bank transfers to them. While it might be tempting to dismiss these as the likely result of an uninformed and gullible customer, the fact is that there is not a single profile for the victims of this type of fraud, and even the most informed and cautious customer might fall victim to it.

The most common type are ‘Romance Scams’. Driven in part by the pandemic, criminals develop relationships with their victims over a span of few weeks or even a few months, until they are ready to carry out the crime.

These scams can be as simple as a person claiming their car has broken down on the way to visit and that they need money to repair it, or a "soldier" that needs funds to fly back home from a deployment abroad.

More recently, scams around helping displaced nationals in Ukraine have been more prevalent, which just shows how fast criminals are reacting and adapting to recent events to find new ways to exploit their victims.

The Queen’s Speech – how will it help to tackle APP Fraud?

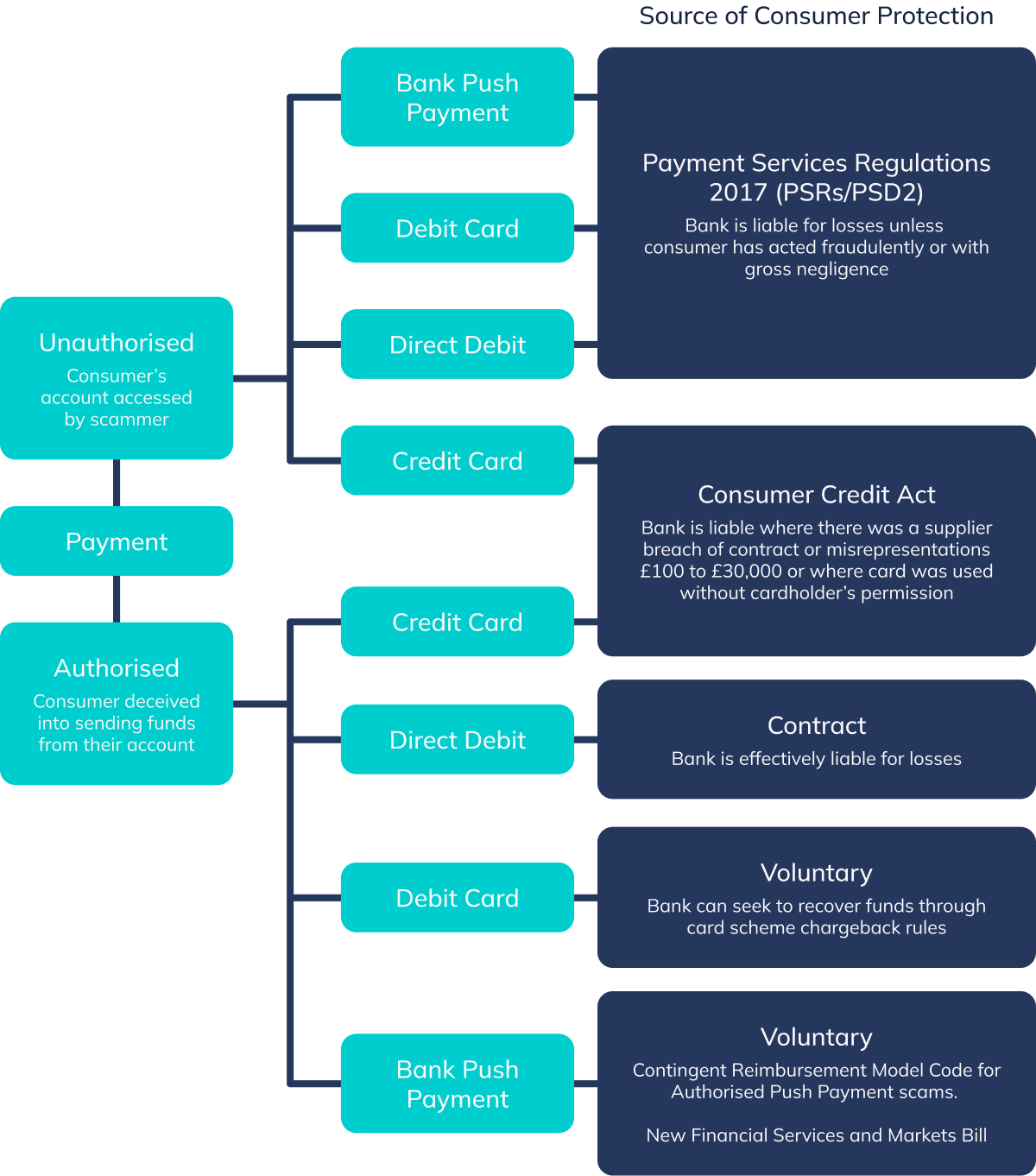

Currently the major issue facing customers affected by this type of fraud, is the lack of a definition of where the liability for this fraud lies as currently there’s no clear definition of what protection a customer is entitled to.

To compare close to 98% of the money lost to card fraud is refunded, whereas those impacted by APP fraud only received 42%.

This is what the new Financial Services and Markets Bill aims to change. By shifting the liability to the Bank the expectation is that the financial impact on the victims will be diminished, essentially solving the problem from the customers’ perspective.

This, however, will not be enough to fix the issue as this type of fraud will still prove to be a financially viable endeavor for criminals, but will come at a greater cost for banks.

The average cost of fraud in 2021 was around £0.11 per transaction which represents the amount of money returned to the victims of fraud. With the constant growth of this type of fraud and this new regulation coming into place, this cost might increase as much as £0.55 per transaction by 2023.

While there have been numerous technologies and industry wide initiatives like Confirmation of Payee, designed to fight this type of fraud, their adoption and rollout has been slow when compared to the rate at which criminals evolve their Modus Operandi.

How we can help

Form 3 is enabling our clients to take a more agile and data-oriented approach to fight fraud than ever by focusing on what we think are the 3 major challenges our clients face.

Connectivity and Orchestration

We are leveraging our single API approach to enable complex orchestration of fraud scans across multiple providers and data points to understand the most cost-effective way to reduce specific vectors of fraud. What historically required long implementation projects and dedicated Program Managers can now be reduced to a simple configuration on Form3’s Platform. This enables our clients to be able to tackle new fraud vectors using innovative technologies in a record time, effectively reducing their cost-of-delay.

Network Data

We believe that to solve the APP Fraud detection problem we should look beyond the origin of the transaction, with a solution that is developed and designed to be deployed at the network level to be able to gain insights into the real fraudulent party, which is the beneficiary and not the originator. Being at the center of multiple transactions in a network allows us to provide insights on accounts that are usually not visible to the individual bank.

Vector specific solutions

Having the privilege to be connected to multiple award-winning providers and having access to network level data, allows us to identify specific solutions that deliver a considerable uplift in detection for specific fraud scenarios. Such is the case for APP fraud, where we have partnered with two of the leading technology providers working on this type of fraud today, to provide a cost-efficient solution for APP Fraud detection using the very same API integration our clients already use.

Written by

Marco Magalhães is Senior Product Manager for Fraud and AML solutions at Form3. With a broad experience working in Fraud and Compliance products at Square, Ocado and PaddyPower, Marco is now focused on helping Form3 grow their Fraud and AML product offering.

Back to News

Back to News